Recession? Yield Curve Inversion, LNG prices, Ukrainian Wheat Exports, and Virginia Budget Battles.

South Park, Buffalo Springfield, Journey, and Parliament - all in one in email!

Virginia FREE Fridays SPECIAL Edition today at 3pm!

We’ll chat about ALL that is going on in Virginia and national politics.

Seriously, is ANYONE paying attention to the Special Session in Virginia? (there are several reasons)

CLICK HERE to join the conversation via Zoom! 3:00pm.

One of my favorite columnists is John Mauldin. He has written recently about the likelihood of an economic recession. Click here for his newsletter - it’s free.

He starts this week’s column:

“I would not interpret the currently very flat yield curve as indicating a significant economic slowdown to come.” (and subprime is contained.)

—Ben Bernanke, March 2006

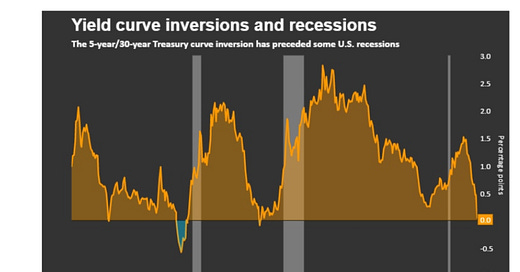

Evidence continues to mount that a recession is coming soon. The latest was this week’s “inverted yield curve” with the 2-year Treasury yield briefly exceeding the 10-year Treasury yield. That’s the opposite of normal. Then again, a bunch of things have been the opposite of normal lately.

And check out this graph:

Energy prices are really moving the needle on the development (supply) front vs. environmental protection so shows this chart from Gallup:

Energy prices not a problem you say? Check out this article in today’s WSJ entitled :

Five paragraphs in and we get to the crux:

There is also some evidence of a switch back toward coal and oil. Valery Chow, vice president at Wood Mackenzie, observed that China, India and Southeast Asia have been resorting to increased coal use for power generation, while industrial customers in India have been switching to naphtha and furnace oil in the face of persistently high and volatile LNG prices.

This is probably a good time to remind folks that cleaner burning natural gas developed here in the U.S. is a still an essential part of a growing economy that CAN AFFORD to move as quickly as possible to more renewables sources.

Prices matter. Rates matter. Those on the lower ends of the income scale are hurt the most with inflation’s unseen level of taxation.

Policies matter.

Then we toss in a miserable ground war in what is ostensibly the grain belt of Europe and look what happens to FOOD insecurity in the countries below.

Pakistan 227 million people. Indonesia 270 million people. Egypt 103 million.

Rising food prices can be very destabilizing. Quickly.

On hold videos today:

South Park Band in China (profanity), Buffalo Springfield, Journey, and Parliament!